Business equipment is essential to any business, and it is vital to know what to do when it breaks down and how to remedy it. According to the United States Small Business Association, cooling expenses can be as much as 60% of a store’s electricity usage. When freezers and coolers break down, store owners can have significant losses. As a business owner, you are looking at losses in repair costs, forfeiture of sales, and food spoilage due to the failures.

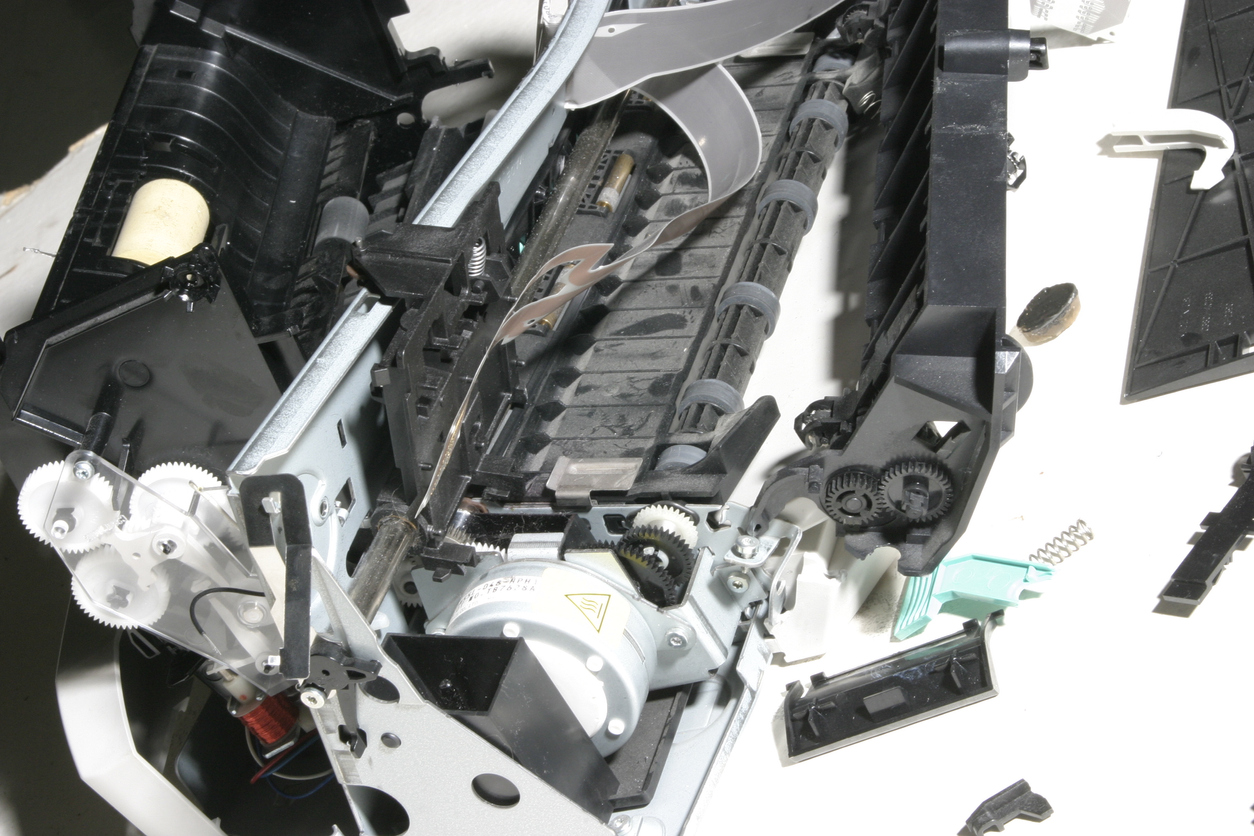

Your systems and machinery can attain some damage through power surges, electrical arcing, centrifugal force, and random failures. Machines have numerous moving parts, increasing the chances of something going wrong. While routine maintenance helps keep everything running smoothly, it is not your only safety net. Equipment breakdown insurance offers financial protection in worst-case scenarios.

What Is Equipment Breakdown Insurance?

You may think your property insurance covers equipment failure, but most property policies do not cover this vital part of your business operations. A comprehensive equipment breakdown policy pays for breakdowns in unexpected situations, equipment failures, and operator errors, leading to about 35% of equipment breakdowns. This coverage can help minimize your losses and put your recovery on a fast track so you can get back to business.

What Does an Equipment Breakdown Policy Cover?

This specialized coverage pays for multiple types of losses, including lost income, equipment damage, and equipment repair.

The right equipment breakdown insurance policy also covers other costs related to equipment failure, including generator rentals.

Look for specific aspects of a comprehensive breakdown insurance policy before signing on the dotted line. For example, you need coverage for your refrigeration equipment. There are, however, other protections the right equipment breakdown policy needs.

- Electrical systems – including switch systems, transformers, and panels

- Security systems – surveillance and security systems

- Storewide air conditioning – multiple costly parts and systems

- Rental equipment costs – including generators so you can stay open

- Electronic retail equipment – including bar code readers, cash registers, and credit card devices

- Boilers – including costs of regular inspections required by law

How an Insurer Can Help

Discover an insurer who meets your business needs and is familiar with your equipment. This specialized knowledge makes them an important ally when something goes wrong. They can speed the repair process and offer helpful preventative tips and advice on maintenance schedules as part of a risk management plan.

The best insurers also access an extensive network of parts suppliers and repair technicians. You can lose customers quickly, and your insurer should help facilitate repairs, pay for temporary solutions, and offer hassle-free reimbursements for losses.

Equipment failure can come at any time. Weather events, malfunctions, and operator mistakes can cause significant problems in daily operations and lead to product spoilage and lost revenue. Insurance for equipment breakdowns can help you breathe easier and focus on delivering quality customer service and healthy employee conditions.

About Provident Protection

For more than 65 years, Provident Protection Plus has served the businesses and residents across several states nationwide. Today, we are a wholly-owned subsidiary of Provident Bank, the region’s premier banking institution. To learn more about our coverage options, contact our specialists today at (888) 990-0526.